What Is Credit Card Tokenization & Why Does My Business Need It?

You may not realize this, but as a small business, you and your staff are an easy target for cybercriminals. You may be asking, 'What could your shop possibly have that these criminals want?' The answer to that is your customers' payment information. The best way to protect that information is to make it useless to them. Tokenization is the key to making that happen.

You may not realize this, but as a small business, you and your staff are an easy target for cybercriminals. You may be asking, 'What could your shop possibly have that these criminals want?' The answer to that is your customers' payment information. The best way to protect that information is to make it useless to them. Tokenization is the key to making that happen.

The Secure Payment Problem

Using various methods, ill-intentioned hackers can steal your customers’ payment card data to commit fraud. This type of data is at risk when it’s kept or stored on your computers, servers, and/or devices.

The less payment information that your organization holds, the better off you are because that means less effort is required to protect that precious data.

But your customers have an expectation of easy transactions, so how can you do both?

The best way to protect this data is to devalue it. ”Encryption” and “tokenization” technologies do this by replacing payment information with data that is useless to hackers.

This all sounds complicated, and it is quite technical. But don't worry, because software like Windward System Five on Cloud can reduce the complexity of putting all of it together.

You see, we've already done the work, and once in place, it makes keeping payments safe much easier to manage in the long run.

What is Tokenization?

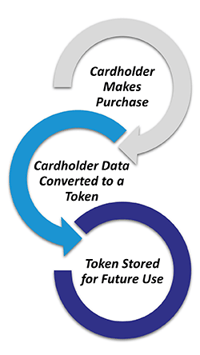

Not to over-simplify it, but Tokenization is used to reduce your risk. Instead of storing a credit card number, you're storing a Token that represents that card for future use. The token can be only used by your merchant account and is meaningless elsewhere.

Why use Tokenization?

Customers demand easy transacting at the stores that they love.

Tokenization enables functions like:

- voids

- refunds/exchanges

- recurring charges

- pre-authorizations for Accounts Receivable

- additional sales situations with "card not present"

Overall satisfaction increases when these functions are handled with ease, and you can have faith that your customer's Card Holder Data is safe.

Protect Your Business

While there are costs associated with getting started on Tokenization, the penalties for non-compliance are extensive.

Credit card companies charge higher rates or simply won't enter into an agreement with businesses that are non-compliant. There are also per month penalties that are not openly discussed for PCI compliance violations.

It is best to protect your business and your customers' best interests by selecting a compliant solution.

Windward System Five on Cloud has fully-integrated Tokenized Credit Card options available for all customers.

We partner with Global Payments and WorldPay by FIS and provide our integrated processing solution to anyone using NETePay Hosted by DataCap Systems.

If you are interested in Windward's integrated credit card processing solution please visit windwardsoftware.com/netepay